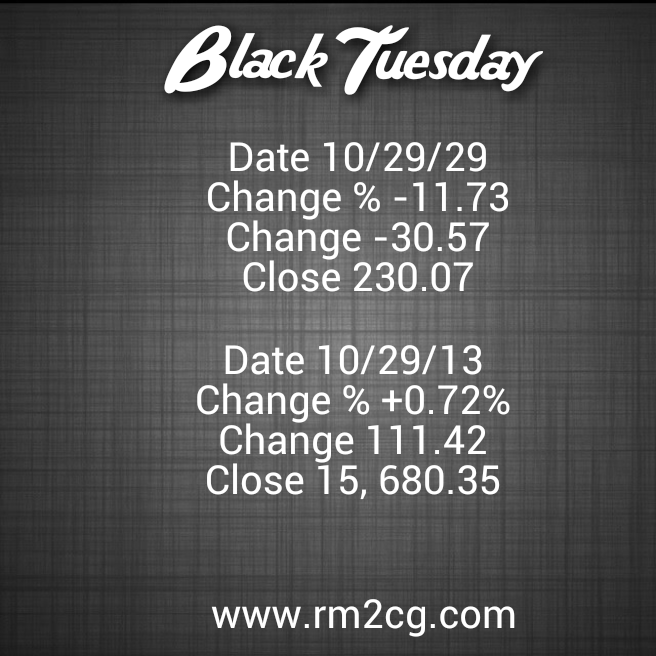

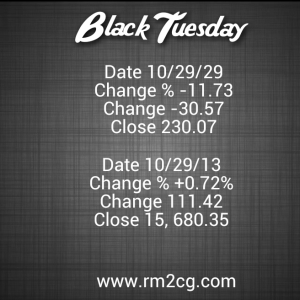

Summary of the Dow Jones Industrial Average on Black Tuesday and the closing numbers for October 29, 2013.

Does anyone remember Black Tuesday? It was the day that marked the beginning of the Wall Street Crash of 1929.

Eighty-four years ago today, we were on the brink of the Great Depression. We call it the Great Depression – not because it was good but because of the scope and duration of this event. Today we are entering into unprecedented territory once again as the market reaches new highs. Reflecting on the last eighty-four years, what lessons have we learned and how can we use that information going forward?

Manage risk properly.

Speculative trading magnifies profits AND losses. Understand the risks going in and develop an appropriate risk strategy. If you are emotionally involved, consider working with a professional to give perspective. You can still make the final decision. I remember a time shortly after 9/11 when the markets were particularly uncertain. I spoke to an investor who sold all of their holdings because they feared losing money. They succeeding in locking in losses and when they finally felt safe enough to buy back in, they purchased at a higher price. Instead of paper losses they realized capital losses. Ouch! They were upset with their decision and in hindsight wished they had not sold at a loss. Tough lesson on the price of allowing your emotions to make your investment decisions.

No one has a crystal ball.

If you had asked someone in 1929 to predict where the stock market would be in 2013, they would have been hard pressed to imagine it would be in the 15,000 range. The truth is that the market will continue to do three things – rise, fall and stay flat. It is possible to make money in each environment and understanding which strategies work best in different market conditions will make you a more successful investor.

Knowledge is power.

Understanding your values, goals, time horizon and risk tolerance pays big dividends. Most people distract themselves with market movements and are looking at those numbers to check their performance. That is useful information however, it is more important to measure your progress towards your goals. The market may be down but if you are on track with your goals, you sleep better at night and it is less scary to open up your quarterly statements. Conversely, the market may be up and if you are not on track to meet your goals, you are feeling a false sense of security and it is time to reevaluate your plan and get back on track. Up, down or sideways – it is important to measure YOUR progress against YOUR goals.

Remember these lessons and learn from Black Tuesday.