by Dedra Murchison | Oct 29, 2013 | Past, Present, Tips

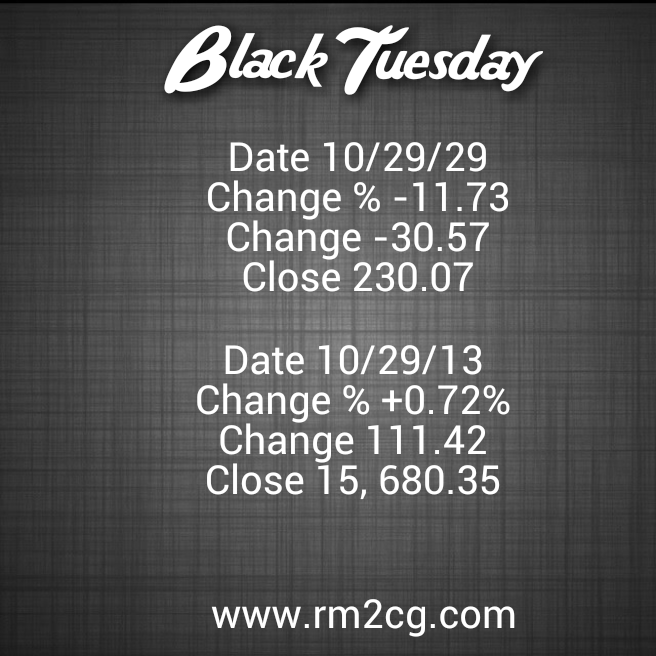

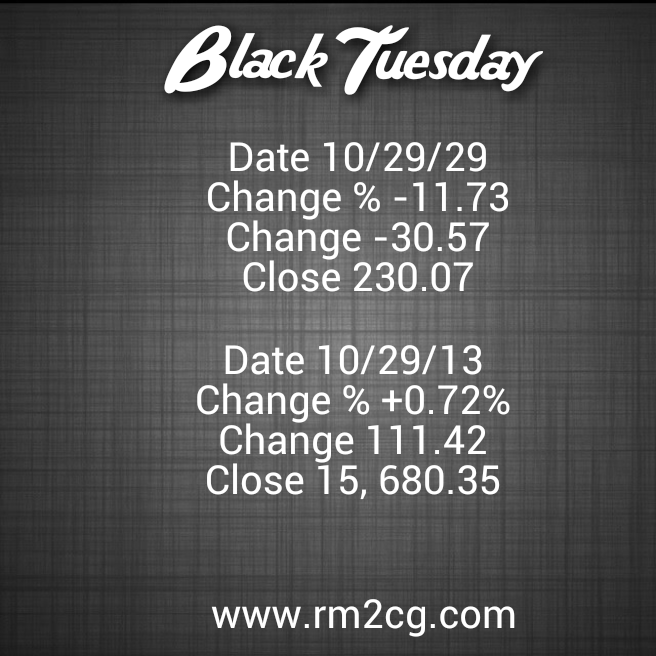

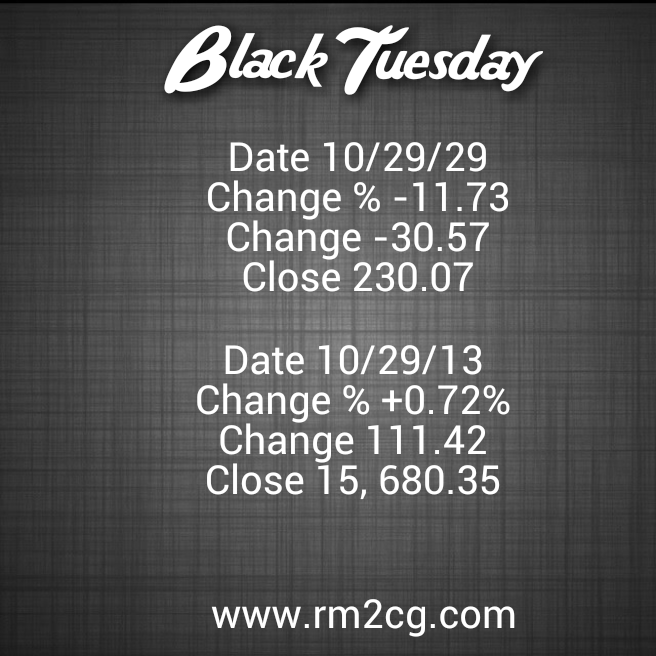

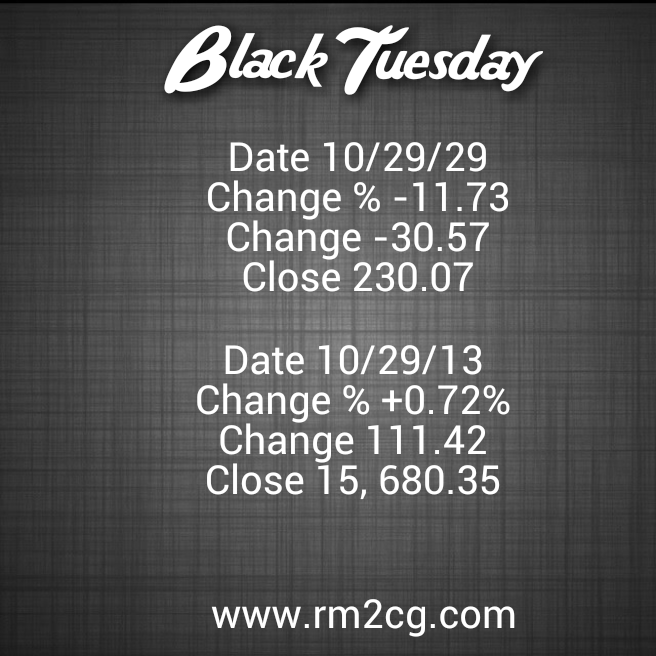

Does anyone remember Black Tuesday? It was the day that marked the beginning of the Wall Street Crash of 1929. Eighty-four years ago today, we were on the brink of the Great Depression. We call it the Great Depression – not because it was good but because of the...

by Dedra Murchison | Oct 4, 2013 | Change, Choice, Money Story, Past, Present, Tips

Past performance is not indicative of future results… This standard disclaimer applies to many investment vehicles. It typically does not apply to human behavior. We are creatures of habit and tend to do the same thing – even when it becomes...

by Dedra Murchison | Sep 11, 2012 | Choice, Past, Present

This message has haunted me these last few days. I believe that UNhappiness is expensive. If you are unhappy and use money to chase happiness, it leads to more unhappiness. So you spend more money and the cycle repeats until you are broke or wake up and realize that...