by Dedra Murchison | Oct 11, 2013 | Change, Choice, Future, Present, Tips

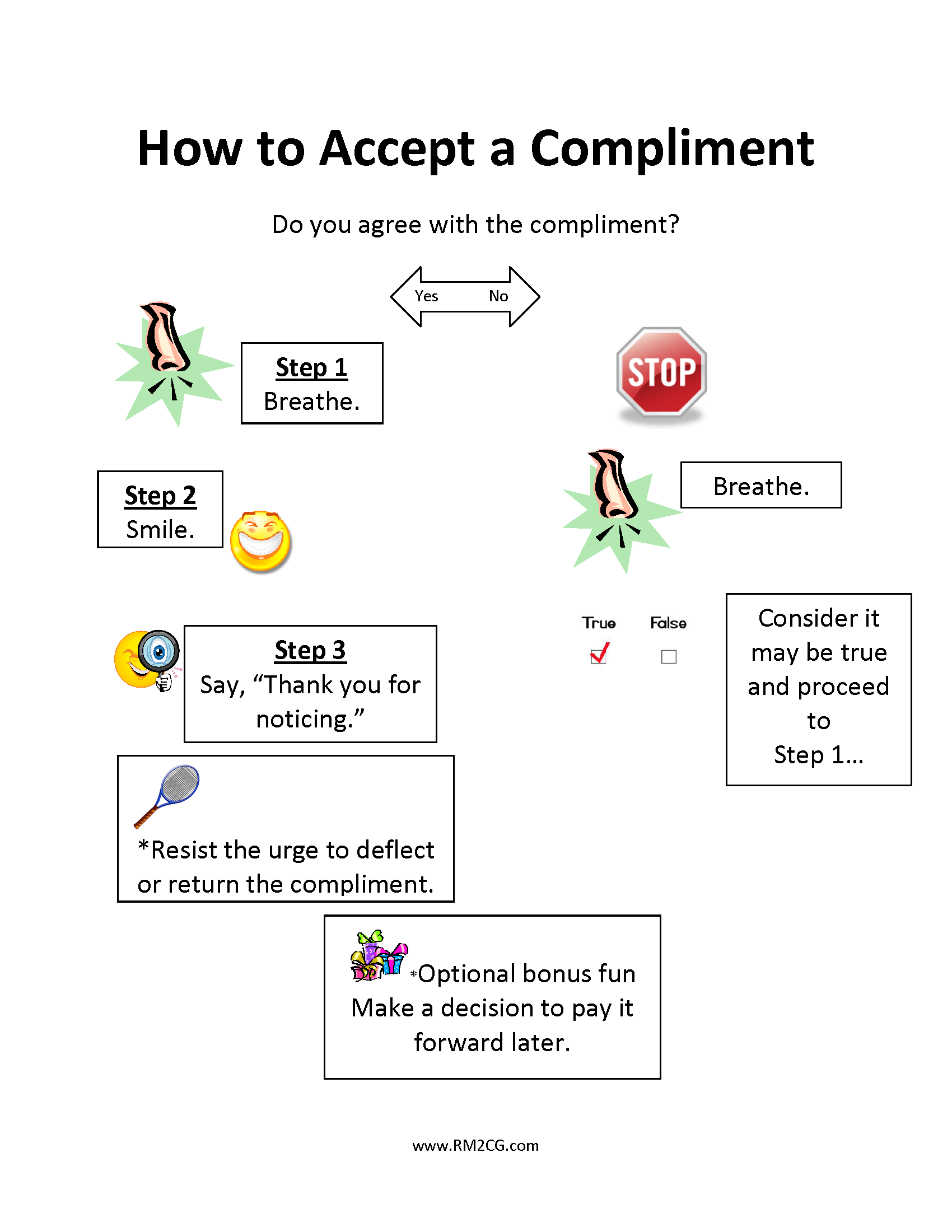

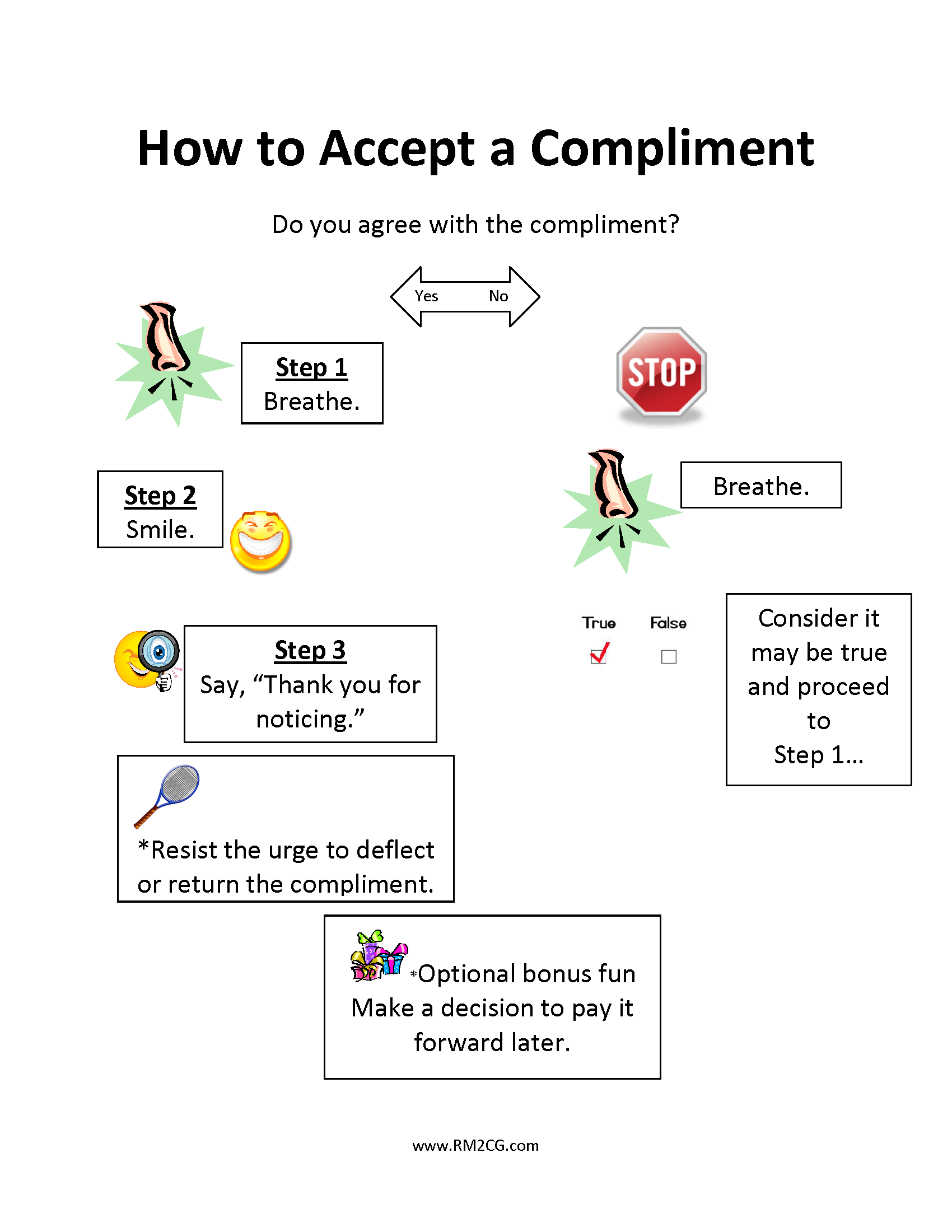

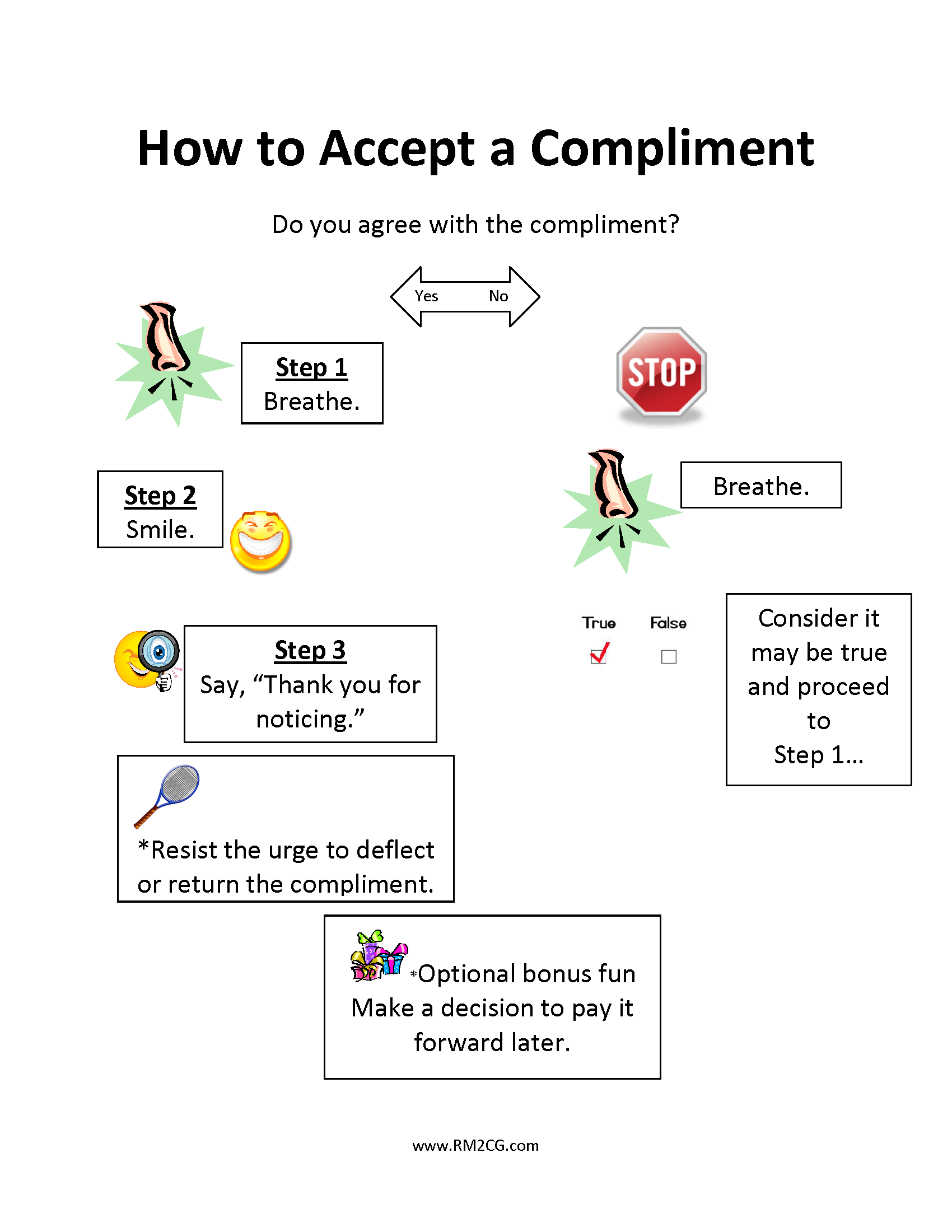

I can take criticisms but not compliments- James Taylor Someone compliments you for the outfit you are wearing or a job well done. Your typical response is: a) “Thank you for noticing.”b) “Oh it was nothing – anyone with a pulse could...

by Dedra Murchison | Oct 8, 2013 | Budget, Change, Choice, Financial Planning, Money Story, Present, Spending Diary, Spending Plan, Tips

Reason #1 to use a spending diary You have more month at the end of your money. Spending diaries are a tool to help you track your spending. Reason #2 to use a spending diary You have a high debt to income ratio. Studies show that when people pay with cash, they spend...

by Dedra Murchison | Oct 4, 2013 | Change, Choice, Money Story, Past, Present, Tips

Past performance is not indicative of future results… This standard disclaimer applies to many investment vehicles. It typically does not apply to human behavior. We are creatures of habit and tend to do the same thing – even when it becomes...

by Dedra Murchison | Sep 11, 2012 | Choice, Past, Present

This message has haunted me these last few days. I believe that UNhappiness is expensive. If you are unhappy and use money to chase happiness, it leads to more unhappiness. So you spend more money and the cycle repeats until you are broke or wake up and realize that...

by Dedra Murchison | Sep 3, 2012 | Choice

This Labor Day I am reflecting on the social and economic achievements of American workers. Do I celebrate by working or taking the day off? Do I go shopping and take advantage of all the sales or do I stay home and resist the urge to spend to save? Spend or save...

by Dedra Murchison | Aug 14, 2012 | Change, Choice, Future, Present, Tips

Ever been on an airplane? My favorite part is when the plane takes off – those rocky moments as the plane begins its ascent. My second favorite part is the safety spiel. The reminder that there are “exits here, here and here…” There is also the part about what...