Reason #1 to use a spending diary

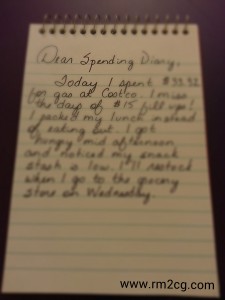

You have more month at the end of your money. Spending diaries are a tool to help you track your spending.

Reason #2 to use a spending diary

You have a high debt to income ratio. Studies show that when people pay with cash, they spend less on purchases then when they pay by credit card. When you track your spending, you are forcing yourself to pay more attention to your spending habits.

Reason #3 to use a spending diary

You are an impulse shopper and find you are buying more than you need. If you write what you are thinking and feeling about your purchases, you can start to look for patterns. For example – you notice that when you shop hungry, you spend more at the grocery store. Once you notice the pattern, you can make different choices and avoid situations that trigger spending sprees.

Reason #4 to use a spending diary

You need to fine tune your budget or spending plan. A spending diary will give you clues about areas that you can cut or increase spending. If you are looking to increase savings, a spending diary focuses on tracking spending so you can spot savings opportunities.

Reason #5 to use a spending diary

You want to check that your spending habits align with your values. When your values and spending are in alignment, you feel better about our choices. For example if you value eating healthy and you are spending all of your food budget on fast food – then you begin to think about your habits and choices and strategize ways to bring your spending back into alignment with your values.

Your comments and questions are always welcome. Need help getting your own financial house in order? Schedule a complimentary session with Money Mentor Coach, Dedra Murchison for one-on-one coaching.

Interesting idea! I have done a lot of tracking my spending, but never really written out what I’m spending and why! Thanks for the idea!

Kristin S recently posted..FOOD-Loaded Potato Chips

You are welcome. Let me know how that experiment goes. By the way, checked out your blog and adore it! Pinterest has replaced my cookbooks.